NACS - Brink's US

Brink’s: NACS SHOW 2023

We make cash convenient.

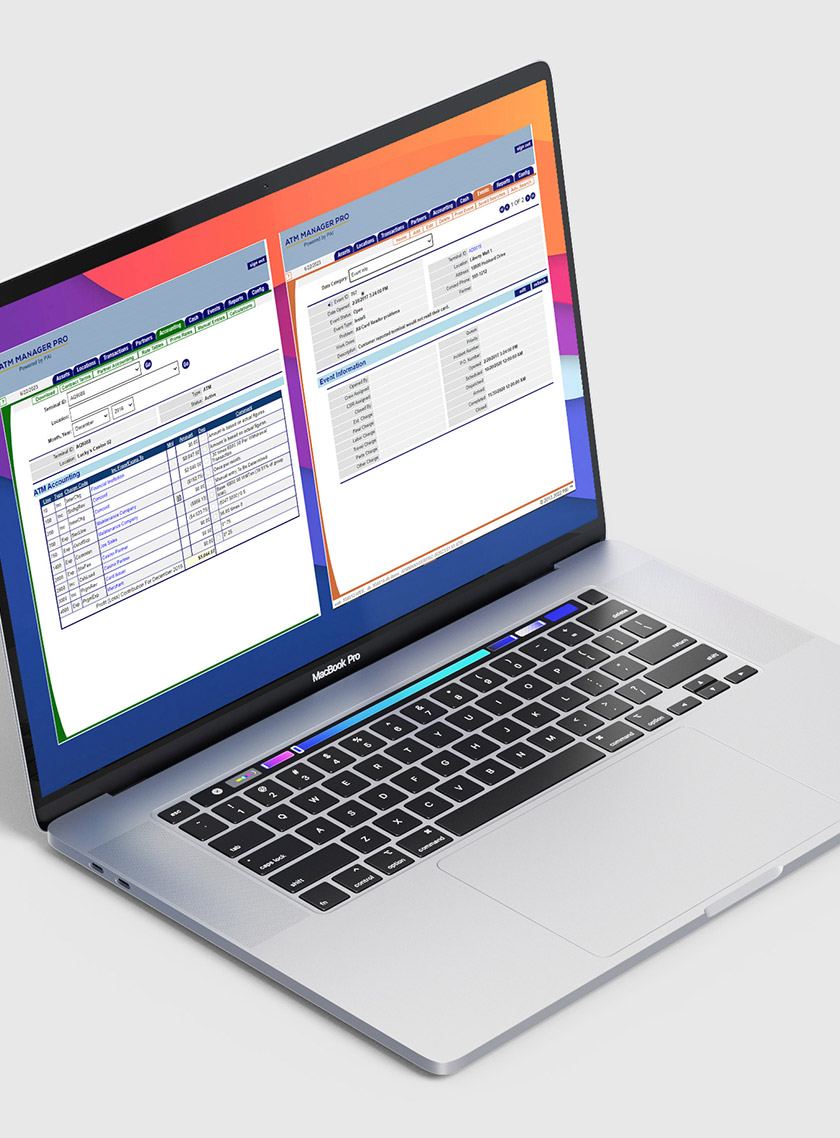

Streamlining your cash and ATM management starts here.

Digital cash management solutions

Simplify your cash management, all while saving time and money.

Minimize cash outages

Our software helps you minimize the risk of cash outages, enabling you to have the right amount of cash in your ATM.

Full visibility into surcharge revenue

See your ATM’s fund balance, operating statistics, transaction volume, surcharge revenue, and more with our reporting dashboard.

Outsourced maintenance and security

You’ve got enough on your plate to think about. Let us handle your ATM hardware, maintenance, and cash loading.

Brink’s Money solutions

Reduce expenses with business solutions that streamline payroll, incentivize employees, and give you control over employee spending.

By the numbers

Exploring the unrealized costs of cash management

The following has evaluated to null or missing:

==> header [in template "20101#20128#HOVER_IMAGE_TEMPLATE" at line 7, column 23]

----

Tip: If the failing expression is known to legally refer to something that's sometimes null or missing, either specify a default value like myOptionalVar!myDefault, or use <#if myOptionalVar??>when-present<#else>when-missing</#if>. (These only cover the last step of the expression; to cover the whole expression, use parenthesis: (myOptionalVar.foo)!myDefault, (myOptionalVar.foo)??

----

----

FTL stack trace ("~" means nesting-related):

- Failed at: ${header.getData()} [in template "20101#20128#HOVER_IMAGE_TEMPLATE" at line 7, column 21]

----

1<div id="${randomNamespace}">

2 <div class="ui-card">

3 <#if (Imagej95j.getData())?? && Imagej95j.getData() != "">

4 <img alt="${Imagej95j.getAttribute("alt")}" data-fileentryid="${Imagej95j.getAttribute("fileEntryId")}" src="${Imagej95j.getData()}" class="hover-img" />

5 </#if>

6 <div class="description">

7 <h3>${header.getData()}</h3>

8 <p>${description.getData()}</p>

9 </div>

10 </div>

11</div>

12

13<style>

14

15*,*:after,*:before {

16 -webkit-box-sizing: border-box;

17 -moz-box-sizing: border-box;

18 -ms-box-sizing: border-box;

19 box-sizing: border-box;

20}

21

22#${randomNamespace} {

23

24 .hover-img{

25 max-width: 100%;

26 }

27 .ui-card{

28 position: relative;

29 width: fit-content;

30 overflow: hidden;

31 transition: all 0.3s ease-out;

32 }

33

34 .ui-card:hover img{

35 border: 5px solid ${hoverColor.getData()};

36 filter: brightness(0.55);

37 }

38 .ui-card .description{

39 position: absolute;

40 top:0;

41 padding: 20px;

42 text-align: center;

43 }

44 .ui-card .description h3{

45 font-weight: 700;

46 font-size: 32px;

47 margin: 0 0 20px;

48 transform: translateY(30px);

49 opacity: 0;

50 transition: all 0.3s ease-out;

51 color:white;

52 }

53 .ui-card .description p{

54 transform: translateY(30px);

55 opacity: 0;

56 transition: all 0.3s ease-out 0.2s;

57 color:white;

58 }

59 .ui-card .description a{

60 color: #fff;

61 display: inline-block;

62 padding: 10px 25px;

63 border-radius: 5px;

64 text-decoration: none;

65 transform: translateY(30px);

66 opacity: 0;

67 transition: all 0.3s ease-out 0.4s;

68 }

69 .ui-card:hover .description h3{

70 opacity: 1;

71 transform: translateY(0px);

72 }

73 .ui-card:hover .description p{

74 opacity: 1;

75 transform: translateY(0px);

76 }

77 .ui-card:hover .description a{

78 opacity: 1;

79 transform: translateY(0px);

80 }

81}

82

83</style>

The following has evaluated to null or missing:

==> header [in template "20101#20128#HOVER_IMAGE_TEMPLATE" at line 7, column 23]

----

Tip: If the failing expression is known to legally refer to something that's sometimes null or missing, either specify a default value like myOptionalVar!myDefault, or use <#if myOptionalVar??>when-present<#else>when-missing</#if>. (These only cover the last step of the expression; to cover the whole expression, use parenthesis: (myOptionalVar.foo)!myDefault, (myOptionalVar.foo)??

----

----

FTL stack trace ("~" means nesting-related):

- Failed at: ${header.getData()} [in template "20101#20128#HOVER_IMAGE_TEMPLATE" at line 7, column 21]

----

1<div id="${randomNamespace}">

2 <div class="ui-card">

3 <#if (Imagej95j.getData())?? && Imagej95j.getData() != "">

4 <img alt="${Imagej95j.getAttribute("alt")}" data-fileentryid="${Imagej95j.getAttribute("fileEntryId")}" src="${Imagej95j.getData()}" class="hover-img" />

5 </#if>

6 <div class="description">

7 <h3>${header.getData()}</h3>

8 <p>${description.getData()}</p>

9 </div>

10 </div>

11</div>

12

13<style>

14

15*,*:after,*:before {

16 -webkit-box-sizing: border-box;

17 -moz-box-sizing: border-box;

18 -ms-box-sizing: border-box;

19 box-sizing: border-box;

20}

21

22#${randomNamespace} {

23

24 .hover-img{

25 max-width: 100%;

26 }

27 .ui-card{

28 position: relative;

29 width: fit-content;

30 overflow: hidden;

31 transition: all 0.3s ease-out;

32 }

33

34 .ui-card:hover img{

35 border: 5px solid ${hoverColor.getData()};

36 filter: brightness(0.55);

37 }

38 .ui-card .description{

39 position: absolute;

40 top:0;

41 padding: 20px;

42 text-align: center;

43 }

44 .ui-card .description h3{

45 font-weight: 700;

46 font-size: 32px;

47 margin: 0 0 20px;

48 transform: translateY(30px);

49 opacity: 0;

50 transition: all 0.3s ease-out;

51 color:white;

52 }

53 .ui-card .description p{

54 transform: translateY(30px);

55 opacity: 0;

56 transition: all 0.3s ease-out 0.2s;

57 color:white;

58 }

59 .ui-card .description a{

60 color: #fff;

61 display: inline-block;

62 padding: 10px 25px;

63 border-radius: 5px;

64 text-decoration: none;

65 transform: translateY(30px);

66 opacity: 0;

67 transition: all 0.3s ease-out 0.4s;

68 }

69 .ui-card:hover .description h3{

70 opacity: 1;

71 transform: translateY(0px);

72 }

73 .ui-card:hover .description p{

74 opacity: 1;

75 transform: translateY(0px);

76 }

77 .ui-card:hover .description a{

78 opacity: 1;

79 transform: translateY(0px);

80 }

81}

82

83</style>

The following has evaluated to null or missing:

==> header [in template "20101#20128#HOVER_IMAGE_TEMPLATE" at line 7, column 23]

----

Tip: If the failing expression is known to legally refer to something that's sometimes null or missing, either specify a default value like myOptionalVar!myDefault, or use <#if myOptionalVar??>when-present<#else>when-missing</#if>. (These only cover the last step of the expression; to cover the whole expression, use parenthesis: (myOptionalVar.foo)!myDefault, (myOptionalVar.foo)??

----

----

FTL stack trace ("~" means nesting-related):

- Failed at: ${header.getData()} [in template "20101#20128#HOVER_IMAGE_TEMPLATE" at line 7, column 21]

----

1<div id="${randomNamespace}">

2 <div class="ui-card">

3 <#if (Imagej95j.getData())?? && Imagej95j.getData() != "">

4 <img alt="${Imagej95j.getAttribute("alt")}" data-fileentryid="${Imagej95j.getAttribute("fileEntryId")}" src="${Imagej95j.getData()}" class="hover-img" />

5 </#if>

6 <div class="description">

7 <h3>${header.getData()}</h3>

8 <p>${description.getData()}</p>

9 </div>

10 </div>

11</div>

12

13<style>

14

15*,*:after,*:before {

16 -webkit-box-sizing: border-box;

17 -moz-box-sizing: border-box;

18 -ms-box-sizing: border-box;

19 box-sizing: border-box;

20}

21

22#${randomNamespace} {

23

24 .hover-img{

25 max-width: 100%;

26 }

27 .ui-card{

28 position: relative;

29 width: fit-content;

30 overflow: hidden;

31 transition: all 0.3s ease-out;

32 }

33

34 .ui-card:hover img{

35 border: 5px solid ${hoverColor.getData()};

36 filter: brightness(0.55);

37 }

38 .ui-card .description{

39 position: absolute;

40 top:0;

41 padding: 20px;

42 text-align: center;

43 }

44 .ui-card .description h3{

45 font-weight: 700;

46 font-size: 32px;

47 margin: 0 0 20px;

48 transform: translateY(30px);

49 opacity: 0;

50 transition: all 0.3s ease-out;

51 color:white;

52 }

53 .ui-card .description p{

54 transform: translateY(30px);

55 opacity: 0;

56 transition: all 0.3s ease-out 0.2s;

57 color:white;

58 }

59 .ui-card .description a{

60 color: #fff;

61 display: inline-block;

62 padding: 10px 25px;

63 border-radius: 5px;

64 text-decoration: none;

65 transform: translateY(30px);

66 opacity: 0;

67 transition: all 0.3s ease-out 0.4s;

68 }

69 .ui-card:hover .description h3{

70 opacity: 1;

71 transform: translateY(0px);

72 }

73 .ui-card:hover .description p{

74 opacity: 1;

75 transform: translateY(0px);

76 }

77 .ui-card:hover .description a{

78 opacity: 1;

79 transform: translateY(0px);

80 }

81}

82

83</style>

Disclaimers:

*Certain exclusions and additional fees may apply. See terms and conditions for more information regarding contents protection.

**All calculations in these sections are estimates based on Brink’s research and customer data, and may vary.